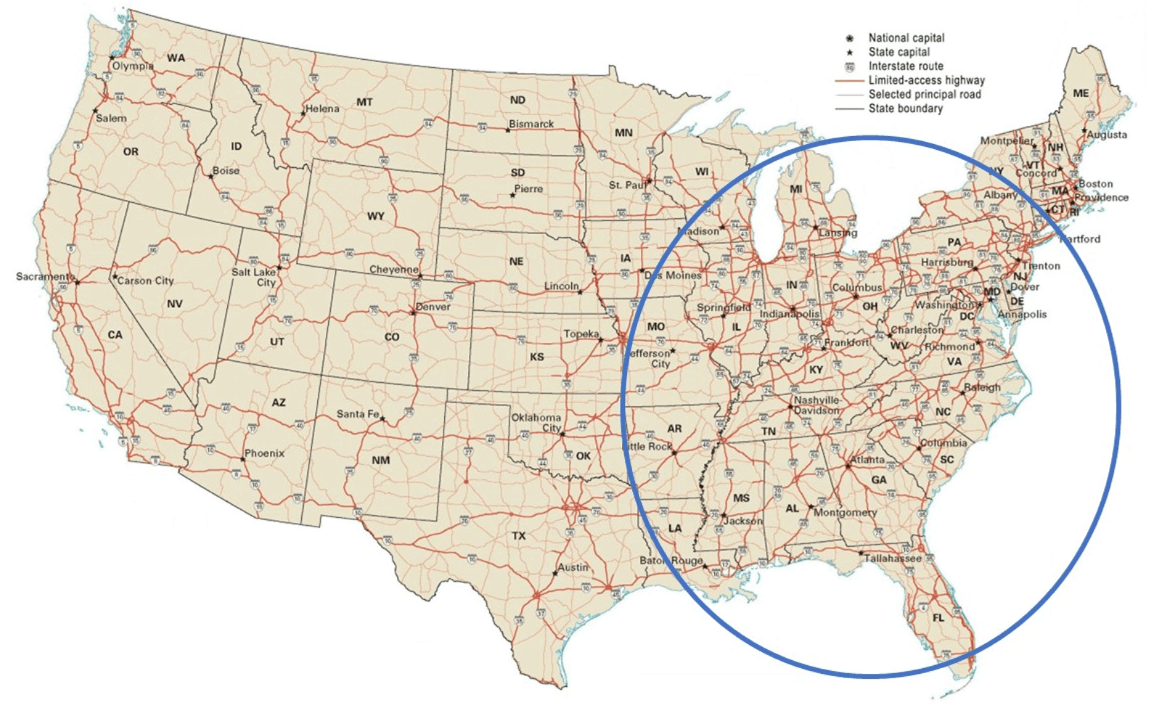

Finding the right deals, in the best possible locations, is integral to driving long-term success here at Heritage Capital. We focus on identifying deals that are strategically located on, or with easy access to major manufacturing and distribution corridors throughout the eastern United States such as those along the 65, 75, 85, 95 freeways i.e. Chicago south and points east), and along the 20, 70, and 80 freeways i.e. approximately from the base of the Great Lakes and points south.

See map below:

Our next investment is under contract. Please join the waitlist for priority access when the deal goes live.

These locations are crucial because they facilitate easy access for trucks to deliver goods. We also pay attention to cities with a hub-and-spoke layout like Atlanta, Cincinnati, Indianapolis, and Columbus, Ohio. We like these kinds of locations and cities because they offer multiple entry and exit points which is beneficial for client logistics operations. We also look for rail access and inland ports.

For example, suppliers to the automotive industry often need to be within a certain distance of an auto plant. This requirement might lead us to markets that are not considered primary or even secondary but are essential for our tenants' operations.

In fact, tenant characteristics play a vital role in our decision-making process when evaluating potential acquisitions. For example, in 2023 we closed an acquisition of an 800,000 square foot building occupied by a single tenant which is not something we usually do.

However, this tenant employs over 500 people across three shifts, making it difficult for them to relocate due to the challenge of replacing such a large workforce. It is easier for them to absorb an increase in rent than to relocate.

We look for tenants who have made significant investments in their space and buildings making it difficult for them to move, yet that offer multiple options or other tenants should we need to find replacements for any reason.

Financial Considerations Drive Decision Making

Our approach is not to chase short-term returns but rather in focusing on opportunities that will remain fully leased and generate superior current cash flow returns and appreciation over time.

Each acquisition is evaluated with the thought: would we own this asset for ten or more years?

Even though we may not hold onto it for that long, this perspective ensures we are prepared to weather economic storms if market conditions change unexpectedly.

The hardest part of what we do is sourcing the acquisition and getting control / under contract. After we operate if for some time, there is always conversation/decision with our investors. Some appreciate the challenges involved and have come to appreciate our approach and enjoy the continued cash flow; that being said…they choose to hold the asset.

Our satellite office in Montana strategically extends our presence westward, enhancing our geographic coverage and ensuring effective management across a broader area. We prioritize locations based on their potential returns: coastal cities often have lower capitalization rates due to their higher property values, whereas inland areas, those rich in manufacturing history, tend to offer higher cash flow opportunities and greater long-term stability.

Tenant Incentives

Careful examination of tenant needs and the incentives they receive play a crucial role in our decision-making process. When a municipality is keen on having a factory built, they might offer various incentives to reduce the cost of operating for businesses in a certain area, making it economically more attractive for them as tenants and for us as landlords.

These incentives can range from back taxes being waived for an extended period, payroll tax exemptions, to even offering land owned by the town or state for free. We have also seen cases where utilities provide preferential treatment on rates to further encourage industrial uses.

These incentives are significant because they help us identify markets where a tenant wants or plans to relocate. Knowing that a tenant has a lower cost basis allows us to assume they will likely stay put for quite some time. Especially in scenarios involving build-to-suit factories, unless something major goes wrong, it is unlikely that the tenant will move due to the high costs and logistical nightmares of relocating equipment and staff.

Work-Friendly Regulatory Climate

Considering whether a state is work-friendly also significantly influences our decision-making process. Work-friendly states might have less strict employment laws or could be more attractive due to their low cost of living, making it easier for employees to relocate there. High housing costs in areas like Los Angeles or New York City can deter potential employees, so locations with affordable living costs become more appealing for establishing long-term operations.

How We Find Opportunities

When it comes down to finding deals, we explore all avenues - brokers, finders who cold call sellers directly, and we even connect with people approaching us seeking partnership opportunities due to their lack of capital or experience.

While we are not always the high bidder on a project, we are still often the winning bidder because we are creative buyers and, in today's market, being creative is critical. For instance, not taking initial cap rates as set in stone but proposing what works for you could yield surprising results.

Recently, we have observed sellers have been more open to negotiation than before to creative deal structures with some even willing to finance significant portions of the acquisition, and remaining in some equity position themselves if it ensures closure. The brokerage community knows how we operate and that we are a reliable partner to bring to deals they may otherwise have had difficulty selling.

Our reputation often precedes us; many know we look for 'broken toys' that others overlook because these assets offer the opportunity for bargains if you understand what is wrong and how it can be fixed. This puts us in the unique position to benefit from circumstances where deals fall through with other buyers.

Broker and Tenant Relationships Create Value

Our relationships with brokers are based on trust and reputation; knowing that if we make an offer early in the process, it will be presented promptly because waiting around is not part of our strategy.

Thanks to this approach, combined with consistent activity in the market space – discussions about active players often include our name across major brokerage firms’ internal meetings – leading them frequently send acquisition opportunities fitting within our investment criteria regardless of geographical boundaries, potentially opening new avenues for exploration based on proven performance metrics.

We have established strong relationships with select brokers who appreciate our straightforward approach. When they present us with an opportunity, we quickly assess its viability. If it aligns with our interests, we move swiftly to contract and guarantee a timely closure.

This reliability has positioned us as preferred partners among the brokerage community; they recognize that our efficient execution often compensates for any slight difference in our offer, making them more inclined to recommend us to sellers.

When examining deals, having a relationship with the tenant can also play a significant role. If it is a national tenant occupying several locations within our portfolio, we have a fair idea of their likelihood to renew, vacate, or modify their space requirements.

We can directly communicate with corporate real estate to gauge their satisfaction with the location. This insider insight gives us an edge over what the seller or broker might know, and we leverage this advantage whenever possible.

In some cases, these relationships can provide opportunities for us to work with our tenants to assist them in locating other locations across the country that we can acquire and lease to them.

Replacement Cost

Replacement cost is another crucial factor in our decision-making process. The idea of ‘replacement cost’ is that by buying at or below this level, to build a new building, a competitor would incur greater costs and, necessarily, have to charge a higher rent to cover that cost.

Consequently, buying at or below replacement cost is preferred because it provides a safety net by ensuring that if economic conditions worsen and tenants vacate, in a worst case scenario the property can still be leased out affordably enough to cover mortgage payments. A lower basis offers more flexibility in leasing strategies.

Cost-Segregation and Tax Avoidance Strategies

In addition, we always conduct cost segregation studies on our properties to maximize depreciation benefits for our investors. Most buildings we invest in are either absolute triple net leases or converted into such arrangements during our tenure. This means we are not responsible for real estate taxes and other operating expenses - these are covered by the tenants.

Tax deferral strategies are integral to what we do; it is not just about how much you make but what you keep that matters most in real estate investments compared to other options like debt funds which generate ordinary income.

Asset Preferences

Our preference leans towards multi-tenant buildings akin to small bay flex industrial spaces which we liken to the multifamily segment of industrial real estate. These properties allow for diversification across many tenants and reduce financial risk if some leases end. It also facilitates staggered lease expirations preventing simultaneous vacancy peaks.

Multi-tenanted spaces are not only easier to finance but also simpler for investors to grasp conceptually using familiar apartment investment analogies but with the added benefit of triple-net leases where tenants bear most operational costs including insurance hikes – making it an attractive proposition for investors once they understand its structure and benefits.

How We Find Deals: The Bottom Line

At Heritage Capital, our real estate investment strategy is crafted to blend strategic location selection, comprehensive tenant analysis, and meticulous financial planning for enduring success. We prioritize properties situated along key transportation routes and in cities designed for optimal logistics efficiency to directly address our tenants' most critical needs. Our commitment to long-term, steady growth with mitigated downside is underscored by our thorough evaluation of each potential acquisition's leasing potential and cash flow returns.

Our approach transcends mere property acquisition; we place a strong emphasis on identifying local tenant incentives, navigating favorable regulatory environments, and implementing tax optimization strategies. Robust relationships with brokers and tenants empower us to identify and act on investment opportunities that might slip past other firms.

This not only helps us manage risks more effectively but also helps ensure our capital and that of our investors is protected for long run growth, income, and asset appreciation.